If it continues operations at its current level, it may remain stunted with little room for growth. So, if the working capital turnover ratio is too large, the company may have reached a saturation point. However, like all good things in this world, the working capital turnover ratio also has its limitations. The result of a high ratio in working capital turnover is a high net annual sales receipt. Hence, it may have a competitive edge over other product or service providers. A high working capital turnover ratio indicates healthy profit generation at a low investment capital or cost. What does a high working capital turnover ratio mean?Įvery company’s primary goal is to generate a high working capital turnover ratio. Hence, you must either improve the business model or curb capital investment to avoid debt. So investing more capital into the existing business model may further reduce profitability in the long run.

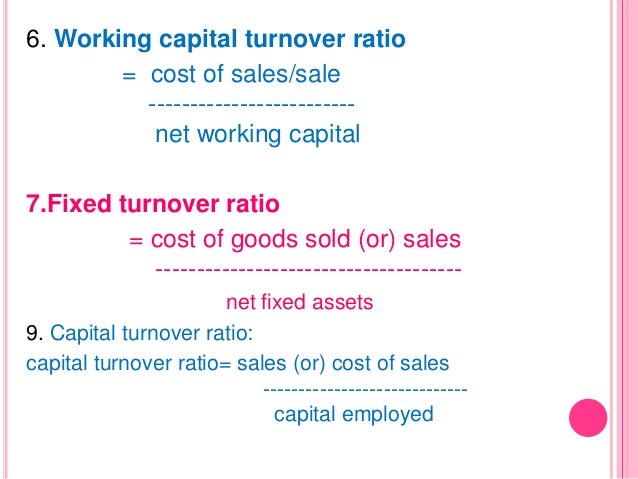

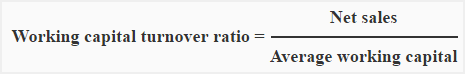

This suggests low financial profitability in the short run. Without knowing your working capital turnover ratio, you cannot manage funds effectively.įor example, suppose you find your company has a poor working capital turnover ratio. Plus, these concepts are a crucial part of working capital management. Working capital turnover ratios can tell you whether your business is:įirst of all, you can calculate your sales growth and take the necessary steps to ensure sustainable business development and a smooth-flowing cash conversion cycle, or net operating cycle. You can’t do this without understanding your business’ working capital turnover ratio. Why is working capital turnover calculated?Īs a business owner or company manager, it’s your job to know what the firm’s financial future looks like. How do you calculate working capital turnover? Moreover, working capital turnover ratios indicate if your company needs additional capital investment and by how much it needs.Īn unreasonably high working capital ratio is a great way to understand how much additional capital to invest. Hence, working capital turnover is a measure of efficiency, whereas the working capital ratio is a measure of asset management. You can use it to understand how much money (profit) you’re gaining per dollar spent from your working capital. On the other hand, working capital turnover ratio talks about a company’s net sales per working capital unit or dollar. The working capital ratio tells us about the company’s asset liquidity and its ability to pay for liabilities, including taxes. How is working capital turnover different from working capital ratio? This will yield a more realistic final average ratio. Hence, consider ignoring outlier asset and liability values when calculating the average working capital. However, the average working capital ratio may be unnaturally skewed if you include outlier values when calculating the average. The average working capital helps provide key insight into your firm's average return on investment. You can calculate the average working capital by measuring the difference between a company's average assets and average liabilities. How do you calculate average working capital?

It is a key indicator of the company’s financial well-being for the near future.Ī firm can find its net working capital by measuring the monetary difference between its current short-term assets and current liabilities. What is working capital?Ī company’s working capital is the net capital or financial liquidity maintained by a firm. You must monitor how your company is generating sales and how much profit each sale provides while using the company's current assets. Moreover, calculating working capital turnover can help a company understand its sales efficiency and ability to sell a product or service.Ĭalculating an accurate working capital turnover ratio demands strict monitoring of all business operations. You can use these two concepts to determine your firm’s working capital turnover ratio and understand the company’s sales performance. Working capital turnover unites two core business tools: a company’s working capital and profit turnover rate.

‘Net sales to working capital’ is another name for the same concept. What is working capital turnover?Ĭompanies use the working capital turnover ratio to measure their success in terms of profits, sales, and overall growth. Read more of this article to have a better understanding of how working capital turnover works. So, how can you know if your business is making a healthy profit? By checking its working capital turnover, of course! This is where working capital turnover ratio is important. However, succeeding is every company’s goal, and the best way to measure this success is by counting your profits. To crush competitors, win clients, and secure a top market share in today’s highly challenging business environment can prove challenging.

0 kommentar(er)

0 kommentar(er)